Promotion

Use code BESTBOOKS24 for 25% off sitewide + free shipping over $35

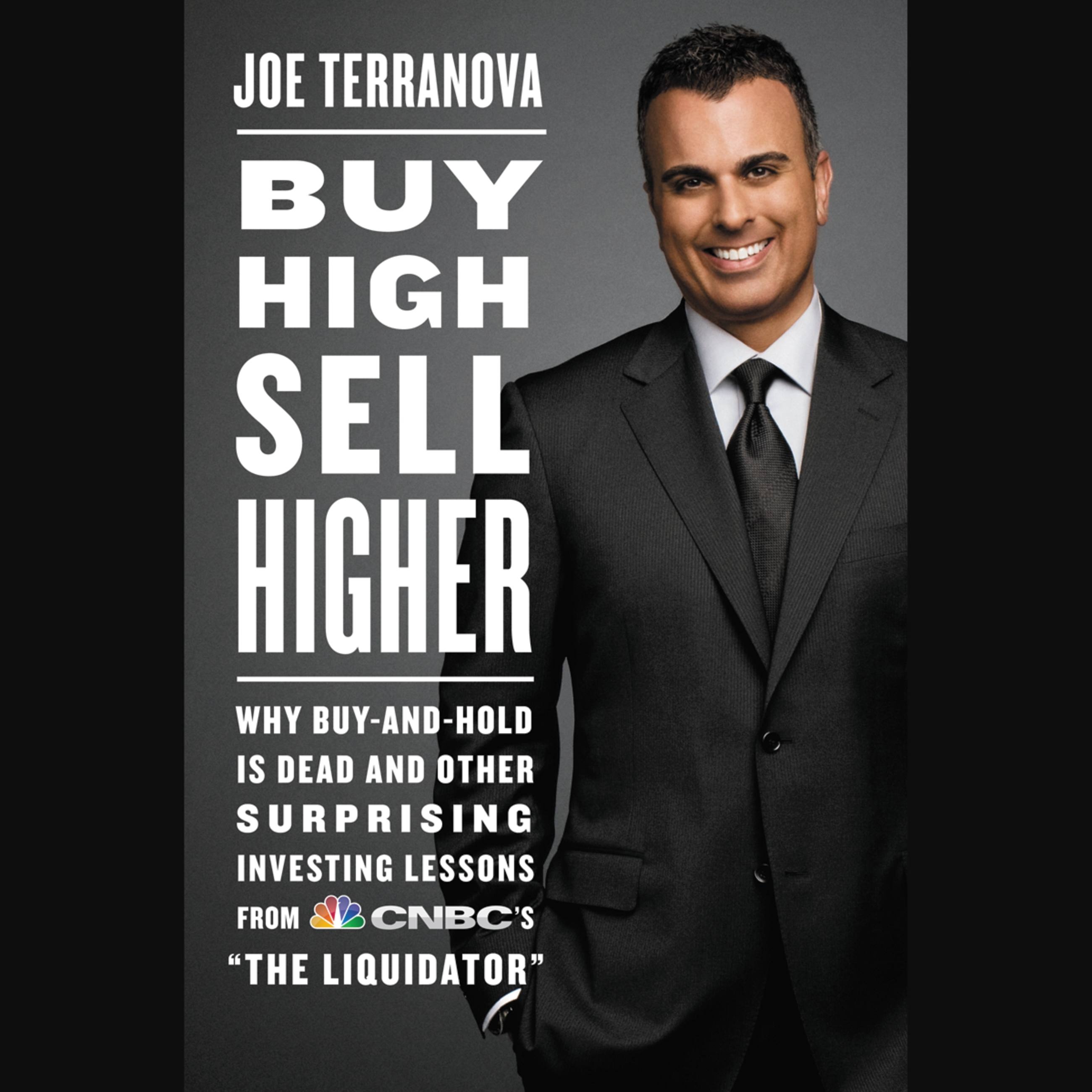

Buy High, Sell Higher

Why Buy-And-Hold Is Dead And Other Investing Lessons from CNBC's "The Liquidator"

Contributors

Read by Joe Terranova

Read by L. J. Ganser

Formats and Prices

Format

Format:

- Audiobook Download (Unabridged)

- ebook $9.99 $12.99 CAD

- Hardcover $26.99 $29.99 CAD

- Trade Paperback $21.99 $28.99 CAD

This item is a preorder. Your payment method will be charged immediately, and the product is expected to ship on or around January 3, 2012. This date is subject to change due to shipping delays beyond our control.

Also available from:

Whether you’re a professional investor or just want to trade like one, Buy High, Sell Higher will show you how to pick winners, maximize gains and minimize losses…In this book, you’ll learn how a stock’s price is just the beginning of the story, and that other indicators like moving averages and volume can help you to spot stocks that have momentum. You’ll also learn how to determine the optimal moment to buy a stock, when to sell it, how to protect yourself against sudden reversals in the market, and how to capitalize on moments when other investors are retreating.

What’s the best month to buy tech stocks? To sell an energy asset? And what is the one-day of the year that you should never, ever trade on? Answers to these and other questions are just some of the insights that Joe Terranova shares in Buy High, Sell Higher.

Terranova is a series regular on CNBC’s Fast Money and the Chief Market Strategist for Virtus Investment Partners, a firm with over $25 billion in assets under management. Prior to joining Virtus, he spent 18 years at MBF Clearing Corp., where he was the director of trading and managed more than 300 traders. And as viewers of CNBC’s Fast Money know, Joe is a master at demystifying the forces that drive today’s markets. So why not let him show you how to use telltale signs to spot investments that are poised for lift-off.

What’s the best month to buy tech stocks? To sell an energy asset? And what is the one-day of the year that you should never, ever trade on? Answers to these and other questions are just some of the insights that Joe Terranova shares in Buy High, Sell Higher.

Terranova is a series regular on CNBC’s Fast Money and the Chief Market Strategist for Virtus Investment Partners, a firm with over $25 billion in assets under management. Prior to joining Virtus, he spent 18 years at MBF Clearing Corp., where he was the director of trading and managed more than 300 traders. And as viewers of CNBC’s Fast Money know, Joe is a master at demystifying the forces that drive today’s markets. So why not let him show you how to use telltale signs to spot investments that are poised for lift-off.

- On Sale

- Jan 3, 2012

- Publisher

- Hachette Audio

- ISBN-13

- 9781611137262

Newsletter Signup

By clicking ‘Sign Up,’ I acknowledge that I have read and agree to Hachette Book Group’s Privacy Policy and Terms of Use