If you think Big Tech has too much power, private equity will knock your socks off.

There’s a cabal of companies that likely controls much of your life, and none of them are a part of Big Tech. In fact, you probably don’t recognize their names — Blackstone, Carlyle, KKR — but they might own the nursing home on your block, the veterinary clinic down the street, the department stores where you holiday shop, and even the emergency room you could one day end up in.

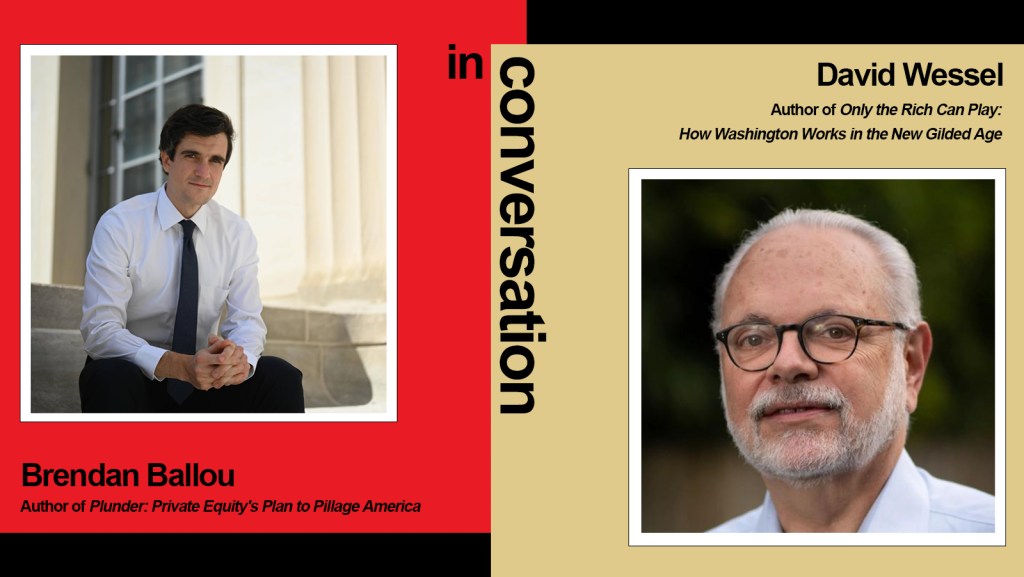

While some of these businesses may be better off under the umbrella of private equity, many will deteriorate and eventually go bankrupt. Meanwhile, the private equity firms can avoid legal liability and continue making billions of dollars and, and it’s all perfectly legal, says Brendan Ballou, a federal prosecutor who served as Special Counsel for Private Equity in the Justice Department’s Antitrust Division.

In his new book, Plunder: Private Equity’s Plan to Pillage America, Ballou explains how private equity has become one of the most dominant forces in American life, why it’s an existential risk to our economy, and how we can reign in its power.

And speaking of the seemingly unstoppable influence of the wealthy, we turn to David Wessel, a Pulitzer Prize–winning journalist and current senior fellow and director of the Hutchins Center on Fiscal and Monetary Policy at the Brookings Institution.

In his most recent book, Only the Rich Can Play: How Washington Works in the New Gilded Age, Wessel pulls back the curtain on Opportunity Zones, an initially overlooked change in the tax code that was meant to encourage the rich to invest in underserved areas. In reality, it created 8,764 tax havens across the country that rarely uplift the communities they were supposed to help.

In our interview, Ballou and Wessel discuss the subtle (and not-so-subtle) ways that the ultra-rich get even richer, why the details are so important, and how regulators are behind the curve.

Note: This interview has been lightly edited for length and clarity. In addition, Brendan’s comments here do not necessarily reflect the views of the Department of Justice, and Wessel’s comments do not necessarily reflect the views of the Brookings Institution.

PublicAffairs: Brendan, can you start off by explaining what, exactly, private equity is?

Brendan Ballou: It’s actually fairly simple: Private equity firms buy and sell businesses by investing a little of their own money, a lot of investors’ money, and a whole lot of borrowed money. They then make operational or financial changes for the companies they buy with the hope of selling them for a profit a few years later. Private equity firms are actually some of the largest actually some of the largest employers in America,, and as an industry they own more businesses than all those listed on US stock exchanges combined.

PA: And why should that concern us?

BB: There are three main reasons. First, PE firms typically buy businesses only for the short term, so they often aren’t particularly interested in making the business better. Second, they often load up these companies with debt and extract enormous fees, which is why so many companies gobbled up by PE tend to go bankrupt.

And third, PE insulates itself from the legal and financial consequences of its actions. That’s troubling in any industry, but when you look at what PE firms control — nursing homes, prisons, health care facilities — it’s especially worrying.

PA: You explain in the book that private equity firms have grown so big partly because they’ve been able to repeal rules they consider disadvantageous. Is that just because of the money they throw at politicians?

BB: That’s certainly part of it. I think as long as politicians need money for reelection, whether they’re Republicans or Democrats, there are few institutions that have as much money as private equity firms, which have given close to $900 million to elected officials since 1990. That’s just an astounding amount of money.

But it’s also that these companies have an enormously deep bench of government officials working for them. We’re talking about secretaries of state and defense and treasury, a vice president, several speakers of the house, and any number of senators and former members of Congress. And in addition to that, they also have got a deep bench of people below the fold, like chiefs of staff and legislative directors. So when a PE firm is lobbying in front of Congress or in front of an agency, they are often doing so with a friendly face.

PA: David, you write about Sean Parker, the Napster founder who was the leading force pushing Opportunity Zones in Congress. Was he successful for the same reason, i.e. he could just throw money at the problem?

David Wessel: Money helped, meaning it gets you in the door. Parker was a campaign contributor, and when he set off on this venture, he diversified his contributions from Democrats to Democrats and Republicans. But I think it was a much more skillful and subtle thing. After all, Mark Zuckerberg tried to do some things on immigration, and he fell flat on his face.

Sean Parker was very smart. He formed a think tank, and they spent a couple of years in stealth mode, building a constituency for the idea that geographic inequality, not just income inequality, was really a problem. He also happened to have a tax break to solve that problem.

The guys who do this at the Economic Innovation Group don’t like my book, but as my brother said, they looked like geniuses. They managed to get something through Congress when so many other people failed.

BB: David, I’m curious. Does their group offer any lessons for organizations that don’t have $15 million to spend on a campaign?

DW: Yes. One is certainly to do your homework, and another is to build a bipartisan coalition. You didn’t have to be a genius to say, “Well, if we get two African American senators, one Republican (Tim Scott) and one Democrat (Cory Booker) to say this is a good idea, a lot of people will agree it’s a good idea.”

But then there’s the part of the story that I’m not so happy with, which is that they essentially wrote the legislation and passed it through Congress with basically no scrutiny.

PA: David, these Opportunity Zones ended up being a huge opportunity for wealthy investors, but few knew it when the law was passed in 2017. Is that for the same reason that Brendan mentioned about private equity — that few people have the time and incentive to dig into the details?

DW: Absolutely. In the book, I described going to this Opportunity Zone expo at the Mandalay Bay Hotel in Las Vegas, which is when I decided this book was worth doing. There were all these people there who couldn’t care less about poor people. They were only interested in how to reduce taxes for their clients. So that’s how people find out about it: their tax advisors, their accountants, their wealth managers. Ordinary people couldn’t take advantage of it and couldn’t possibly understand it.

PA: Brendan, you write about the flagrant ways that PE influences the government, like the enormous lobbying effort. But you also mention more subtle ways. So just how far ahead is private equity in being able to manipulate regulations and how far behind are the regulators?

BB: I think what’s really important to get across about private equity is that the people who run these firms are rarely experienced in actually managing companies. They’re finance people, and they’re extremely knowledgeable at identifying and exploiting gaps in our regulatory system.

Part of their success is that they have the interest and the ability to really get into the details, and there really is not a countervailing force helping to explain to agency staffers and to members of Congress that, you know, this tiny change in disclosure obligations or pension obligations can be really harmful for ordinary people.

PA: Speaking of oversight, David, you write that there isn’t even an application process for Opportunity Zones. What do we make of the lack of regulation here?

DW: Sean Parker and the guys at the Economic Innovation Group thought that other government programs to help the poor were strangled by too much regulation. And there’s a case that there’s quite a bit of red tape there, but they went too far in the other direction, and I think they were arrogant in that regard. They deliberately tried to avoid oversight. In fact, we don’t really have any good records of where exactly the money is going. Even though the OZ fund has to file reports with the IRS, they aren’t public. So they overdid it, and I think they recognize that now that it’s too late.

PA: So where does that leave us when it comes to solutions? Brendan, should we do our best to end private equity entirely? David, should we repeal Opportunity Zones?

BB: No, the solution is to make private equity think for the long term, take legal and financial responsibility for their actions, and not load up the companies that they buy with onerous debt. If you do those things, private equity, just like any other form of investment, can be incredibly valuable

DW: What Brendan says is exactly right. We don’t have enough guard rails, and particularly given the way the tax code treats interest and debt, we encourage them to borrow a lot of money, and there’s not much accountability when something goes wrong.

As for the Opportunity Zones, it does make you think sometimes, “Why don’t we just raise taxes on rich people, and then the government could choose where to allocate those resources?” Well, there are two problems. First, it’s hard to raise taxes, even on rich people. And secondly, let’s not overdo it. The government isn’t always good at picking the right places to invest, either.